The power of compounding in investments is like magic for long-term wealth creation. Even a slight difference in return rates or investment duration can significantly affect your retirement savings. In simpler words, compounding means earning returns on your returns, and its effect on long-term investments is huge. This is why starting your retirement planning early can make a big difference. Let’s break down how adding just two more years to your investment and getting a 2% higher return can double your retirement fund.

What is Compounding and Why Does it Matter?

Compounding happens when your investments generate returns, and those returns, in turn, generate even more returns. To make it clearer, let’s take an example: if you invest Rs 1 lakh and earn a 10% return, after a year, your amount grows to Rs 1,10,000. The next year, you will earn interest on this Rs 1,10,000, not just the original Rs 1 lakh. Over time, this creates a snowball effect, multiplying your savings faster.

For long-term investors, especially in mutual fund SIPs, compounding plays a crucial role. While fixed-income investments also benefit from compounding, their interest rates are fixed. In contrast, SIPs (Systematic Investment Plans) can generate higher or lower returns, depending on market performance. On average, a long-term SIP can fetch an annual return of 12-15%.

Example of Power of Compounding in SIP

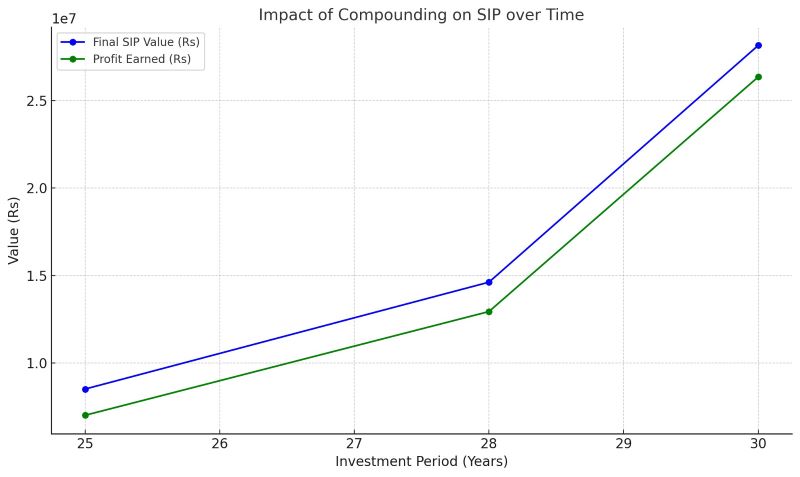

Let’s take a look at three cases that show how compounding works in a monthly SIP investment:

Case 1: 25 Years of SIP at 12% Return Per Year

- Monthly SIP: Rs 5000

- Annual Return: 12%

- Investment Duration: 25 years

- Total Investment: Rs 15,00,000

- Final SIP Value: Rs 85,11,033

- Profit Earned: Rs 70,11,033

Case 2: 28 Years of SIP at 13% Return Per Year

- Monthly SIP: Rs 5000

- Annual Return: 13%

- Investment Duration: 28 years

- Total Investment: Rs 16,80,000

- Final SIP Value: Rs 1,46,22,103

- Profit Earned: Rs 1,29,42,103

Case 3: 30 Years of SIP at 15% Return Per Year

- Monthly SIP: Rs 5000

- Annual Return: 15%

- Investment Duration: 30 years

- Total Investment: Rs 18,00,000

- Final SIP Value: Rs 2,81,58,852

- Profit Earned: Rs 2,63,58,852

Impact of 2 Extra Years and 2% Higher Return

The example above shows how adding just 2 more years to your investment period, along with a 2% increase in returns, can make a massive difference. If you invest Rs 5000 per month for 28 years at a return of 13%, your retirement corpus will be around Rs 1.5 crore. However, by simply extending the investment period by 2 years and achieving a 2% higher return (15% instead of 13%), your retirement fund will grow to Rs 2.82 crore.

Here is the table with the calculations for the three investment scenarios:

| Years | Annual Return (%) | Monthly SIP (Rs) | Total Investment (Rs) | Final SIP Value (Rs) | Profit Earned (Rs) |

| 25 | 12 | 5000 | 1,500,000 | 8,511,033 | 7,011,033 |

| 28 | 13 | 5000 | 1,680,000 | 14,622,103 | 12,942,103 |

| 30 | 15 | 5000 | 1,800,000 | 28,158,852 | 26,358,852 |

The graph above shows how the final SIP value and profit earned increase over time due to the power of compounding.

Key Takeaway: The Longer You Stay Invested, the Bigger the Benefits

The longer you stay invested, the bigger the impact of compounding. In the long term, even a slight increase in return rates and investment duration can lead to huge differences in the final amount. This is why starting your investment journey as early as possible is essential, and why reviewing your investments for potential higher returns can be a game-changer.

Compounding is like growing a money tree. The earlier you plant it and the better you nurture it, the larger it grows. Whether you are saving for retirement or any other long-term goal, always remember that time and return rates work hand-in-hand to boost your wealth exponentially.