In today’s fast-paced financial world, your PAN card is more than just a tax identity—it’s a key that links almost every financial transaction you make. Whether it’s applying for a credit card, personal loan, car loan, or even a mortgage, your PAN (Permanent Account Number) is the identifier lenders use to track your creditworthiness. It is essential to know how many loans are active against your PAN.

If you’ve ever wondered, “How many active loans are linked to my PAN card?”—you’re not alone. This is one of the most common queries among borrowers, especially those managing multiple loans or suspecting fraudulent use of their PAN.

Let’s break it down in a simple, step-by-step guide to help you check all loans active under your PAN card—fast, securely, and for free.

Why Your PAN Card Is Linked with Loans

Lenders like banks, NBFCs, and even digital loan providers report your loan data to credit bureaus using your PAN number. This includes:

- Loan approvals

- EMI payment history

- Defaults or missed payments

- Loan closures

So, your PAN acts as a tracker across India’s entire financial system. If someone misuses your PAN or if you forget to close a loan account properly, it still reflects in your credit history.

The Most Reliable Way: Check Your Credit Report

Accessing your credit report is the best and most accurate way to check all active loans linked to your PAN card.

What is a Credit Report?

A credit report is a detailed document that shows your complete credit history, including all current and past loans and credit cards. It shows:

- The type of loan (personal, education, car, home, etc.)

- Loan amount sanctioned

- Amount Outstanding

- EMI payment history

- Default status (if any)

Where to Get Your Credit Report

In India, there are four major credit bureaus authorized by the RBI:

- CIBIL (TransUnion CIBIL)

- https://www.cibil.com

- Equifax

- https://www.equifax.co.in

- Experian

- https://www.experian.in

- CRIF High Mark

- https://www.crifhighmark.com

You can get one free credit report per year from each bureau. You can check your report monthly at no cost—once from each bureau.

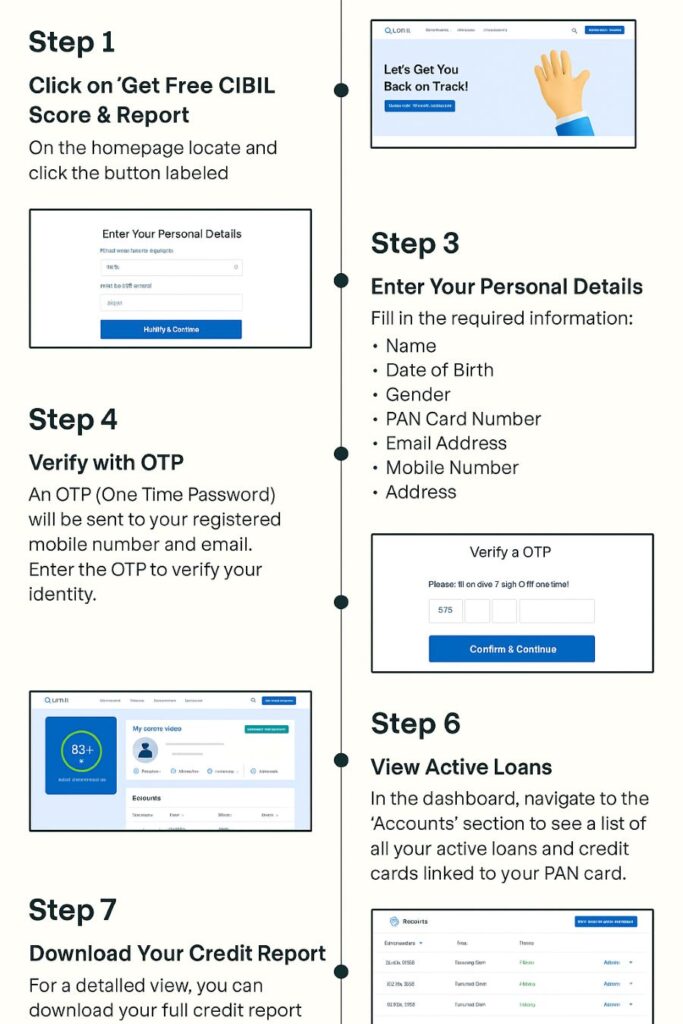

Step-by-Step Guide: How to Check Active Loans via CIBIL

Let’s go through the process using CIBIL, the most widely used credit bureau in India:

- Visit the official CIBIL site – https://www.cibil.com

- Click on “Get Your Free CIBIL Score.”

- Register using your name, date of birth, PAN number, email ID, and mobile number

- You will receive an OTP on your mobile—verify it

- Once registered, log in to your account

- You will see a dashboard with your CIBIL score

- Click on “Credit Report” to view all loans linked to your PAN

Check here:

The report will list every loan account (active or closed), current balance, EMI record, and the lender’s name.

How to Spot Fraud or Errors in Your Report

Sometimes, the report may show loans that you don’t recognize. This can happen due to:

- PAN misuse for fraud

- Clerical errors by the lender

- Loans taken long ago and not properly closed

Here’s what you should do:

- Double-check loan details – Check the lender’s name, sanction date, and EMI pattern

- Raise a dispute with the credit bureau via their “Dispute Resolution” option

- Contact the lender directly if the mistake is in their reporting

Using Other Credit Bureaus for Cross-Verification

Since different banks report to different bureaus, you may find slight variations in your report. It’s a good idea to check with other bureaus like:

- Equifax: Visit https://www.equifax.co.in → Go to “Get My Credit Report” → Enter your PAN and verify

- Experian: Visit https://www.experian.in → Choose “Check Your Experian Credit Score” → Follow similar steps

- CRIF High Mark: Visit https://www.crifhighmark.com → Select “Personal Credit Score” → Fill in PAN and basic details

Each report will show loans tracked under your PAN.

Use Credit Aggregator Apps for Easier Access

There are also trusted financial apps and fintech platforms that help you view your credit report instantly:

- Paytm

- BankBazaar

- Bajaj Finserv

- Paisabazaar

- OneScore

Most apps let you download your CIBIL report for free by verifying your PAN and phone number. These platforms sync directly with credit bureaus.

What Details You’ll See in the Report

Your credit report typically includes:

- PAN number and identity details

- The current outstanding on each loan

- Payment history (timely or delayed)

- Loan tenure and EMI status

- Date of loan sanction and closure (if applicable)

This gives you a complete view of your credit exposure and helps with financial planning.

Why It’s Important to Check Loans Linked to Your PAN

Checking your active loans on PAN is not just for curiosity. It serves several practical purposes:

1. Prevent Identity Theft

If someone misuses your PAN to take loans, you’ll know instantly by checking your report.

2. Maintain Good Credit Health

Too many active loans can lower your credit score. It’s better to know where you stand.

3. Avoid Loan Rejection

When applying for a new loan, lenders check your credit report. Multiple existing loans can lead to rejections due to high credit usage.

4. Fix Errors on Time

If a loan is closed but still marked “active,” it can affect your credit score. Disputing such errors early helps you stay clean.

Key Tips to Remember

- Check your credit report at least once every 3 months

- Always check through official sites or RBI-authorised apps

- Never share your PAN and OTP on unknown or non-verified websites

- Keep track of your loan EMI schedules and closure certificates

- Dispute incorrect loans immediately to avoid long-term damage

Final Thoughts

Knowing how many loans are active against your PAN card is now easier than ever. You can stay in control of your financial health by using credit bureau platforms, trusted apps, and a little attention to detail. Monitor your PAN-linked activities regularly to stay safe from fraud and keep your credit profile strong.

Sources: TransUnion CIBIL, Equifax India, Experian India, CRIF High Mark