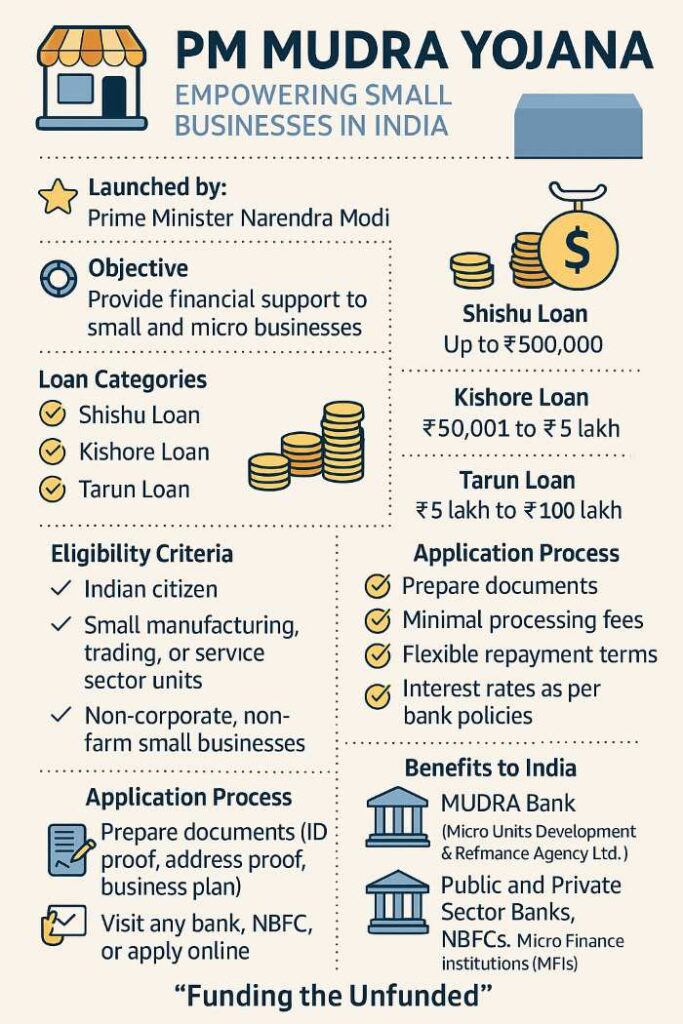

Small businesses and startups are the backbone of the Indian economy. They create jobs, boost local economies, and encourage innovation at the grassroots level. However, many of them face a common problem — a lack of easy access to funds. Understanding this critical need, the Government of India launched the Pradhan Mantri Mudra Yojana (PMMY) in 2015 to offer financial support to micro and small enterprises.

Under PM Mudra Yojana, small businesses can get easy, collateral-free loans up to Rs. 10 lakh through banks, non-banking financial companies (NBFCs), and microfinance institutions (MFIs). The aim is simple — to empower entrepreneurs, encourage self-employment, and make India stronger from the bottom up.

Main Objectives of PM Mudra Yojana

The PM Mudra Yojana was designed with some very clear goals in mind:

- Provide funding to non-corporate, non-farm small and micro enterprises.

- Promote entrepreneurship across all sectors.

- Bring informal small businesses into the formal banking system.

- Offer financial services at affordable interest rates.

- Support employment generation through small industries.

The scheme has been a major force in helping people who otherwise could not access loans easily, such as small shop owners, artisans, vegetable sellers, repair shops, and service businesses.

Who Can Apply for PM Mudra Yojana?

The PM Mudra Yojana is meant for a wide variety of small and micro-businesses. The following types of people and businesses are eligible:

- Small manufacturing units

- Shopkeepers

- Fruit and vegetable sellers

- Repair shops (motor, cycle, machine repairs)

- Small industries like food processing

- Artisans and craftspeople

- Beauty parlours, gyms, and small salons

- Transport operators (rickshaw, taxi, small truck owners)

- Startups and new micro-businesses

- Service-based businesses like tailoring, dry cleaning, etc.

Both new and existing businesses can apply for a Mudra loan under this scheme.

Types of Loans Under PM Mudra Yojana

PM Mudra Yojana offers three types of loans based on the stage and size of the business:

1. Shishu Loan

- Loan Amount: Up to Rs. 50,000

- Purpose: For new businesses or very small startups

- Ideal for: First-time entrepreneurs or small-scale setups

- Features: Minimal documentation, low interest rates, fast processing

2. Kishore Loan

- Loan Amount: Rs. 50,001 to Rs. 5 lakh

- Purpose: For businesses that are already running but want to expand

- Ideal for: Businesses needing extra working capital or planning upgrades

- Features: Moderate paperwork, credit history considered, competitive rates

3. Tarun Loan

- Loan Amount: Rs. 5 lakh to Rs. 10 lakh

- Purpose: For businesses looking for bigger expansion

- Ideal for: Well-established small businesses with good credit profiles

- Features: Detailed documentation, thorough verification, flexible repayment

Each category is tailored to meet different business needs and growth stages.

Key Features and Benefits of PM Mudra Yojana

The PM Mudra Yojana comes with a lot of attractive features that make it highly popular among small entrepreneurs:

- Collateral-Free Loans: No need to provide any security or assets to get the loan.

- Affordable Interest Rates: Rates vary slightly from bank to bank but are lower than regular business loans.

- No Hidden Charges: Transparent processing with no hidden fees.

- Flexible Repayment Tenure: Repayment periods can extend up to 5 years depending on loan size.

- Support for Women Entrepreneurs: Special discounts and incentives for women business owners.

- Easy Accessibility: Available through a wide network of banks, MFIs, NBFCs, and even online platforms.

- Coverage of Multiple Sectors: Available for manufacturing, services, trading, and other sectors.

- Financial Empowerment: Helps marginalised sections like SC/ST/OBC and minorities to become financially independent.

Documents Required for PM Mudra Yojana

To apply for a Mudra loan, you need to keep certain documents ready:

- Identity Proof: Aadhaar Card, PAN Card, Voter ID, Driving License

- Address Proof: Utility bills, Passport, Aadhaar

- Business Proof: Registration certificate, shop license, GST registration (if applicable)

- Bank Statements: Last six months’ statements

- Quotation or Estimation: For machinery, tools, equipment, or service expansion costs

- Photographs: Passport size photographs

Some banks might ask for additional documents based on the type and size of the loan.

Step-by-Step Process to Apply for a PM Mudra Yojana Loan

Applying for a Mudra loan is easy if you follow these simple steps:

Step 1: Identify the Loan Category

First, decide which category (Shishu, Kishore, or Tarun) your loan requirement falls into based on how much money you need.

Step 2: Choose the Right Bank or Institution

You can apply for a Mudra loan through:

- Public Sector Banks

- Private Banks

- Regional Rural Banks (RRBs)

- Micro Finance Institutions (MFIs)

- Non-Banking Financial Companies (NBFCs)

- Small Finance Banks

You can also check online portals of many banks that now offer digital Mudra loan applications.

Step 3: Fill Out the Application Form

Collect the Mudra Loan Application Form from the bank or download it from the official bank website. Fill it carefully with accurate business details.

The application form will require:

- Personal details

- Business details

- Loan amount needed

- Purpose of the loan

- Repayment plan

Step 4: Attach All Required Documents

Submit your identity, address, and business proofs along with your bank statements and other required documents.

Step 5: Submit and Wait for Processing

After submitting your application, the bank will verify your documents and conduct background checks. If everything is satisfactory, your loan will be approved.

Step 6: Loan Disbursement

After approval, the loan amount will be credited directly to your bank account. In some cases, banks may also offer Mudra cards (similar to credit cards) for flexible withdrawal.

Important Points to Keep in Mind

- Always maintain a good credit score, especially if applying for Kishore or Tarun loans.

- Use the loan only for the purpose you have mentioned in your application.

- Ensure timely repayment to avoid penalties or negative impact on your credit profile.

- Subsidies or interest reductions might be available if the loan is linked with other government schemes.

- Check for Mudra loan camps organised in your city for quick processing.

How PM Mudra Yojana is Changing Lives

Since its launch, PM Mudra Yojana has transformed millions of lives across India. From street vendors to young entrepreneurs starting tech startups, Mudra loans have become the lifeline of India’s small business dreams.

Here’s how Mudra Yojana is making a difference:

- Job Creation: By helping businesses grow, Mudra loans have indirectly created thousands of new jobs.

- Women Empowerment: A large percentage of Mudra beneficiaries are women entrepreneurs, promoting gender equality in business.

- Financial Inclusion: People who never had a bank account or credit history are now part of the formal economy.

- Village Development: Small enterprises in rural areas have seen major growth, leading to overall village development.

- Boost to Startup Culture: Many new-age startups have taken their first step with a small Mudra loan.

Challenges Faced by PM Mudra Yojana

While PM Mudra Yojana has been highly successful, it has faced certain challenges too:

- Loan Defaults: In some cases, borrowers have defaulted, leading to rising Non-Performing Assets (NPAs).

- Lack of Business Knowledge: Many small entrepreneurs lack financial literacy, which affects their repayment ability.

- Documentation Issues: Some businesses in rural areas struggle to provide formal documents.

- Overlapping Loans: Some people take multiple small loans from different lenders, creating a repayment burden.

The government and financial institutions are working continuously to improve awareness, provide training, and monitor the scheme better.

The Future of PM Mudra Yojana

Looking ahead, PM Mudra Yojana is expected to get even bigger. Some key future developments could include:

- Greater digitalization of loan applications.

- More partnerships between banks and fintech companies.

- Increased focus on rural entrepreneurship.

- Better post-loan support like business training and mentorship.

- Expansion of Mudra Plus — enhanced credit limits for successful borrowers.

The government’s focus on ‘Atmanirbhar Bharat’ (self-reliant India) means that schemes like PM Mudra Yojana will play an even more important role in empowering small businesses and boosting the economy.

Sources: Ministry of Finance, Mudra.org.in, RBI Reports