Foreign Institutional Investors (FIIs) have shown increasing confidence in the Indian stock market this September, making it their preferred destination among emerging markets. With a whopping $219 million in purchases so far this month, India’s market has attracted more investment compared to countries like Vietnam, Brazil, South Korea, and Taiwan. While FIIs have withdrawn from other markets, their trust in the Indian economy is clear. Experts are optimistic about continued inflows but also warn of challenges ahead.

Experts Caution on Liquidity Management Amid Surging FII Inflows

Gaurang Shah, Head of Investment Strategy at Geojit Financial Services, believes that further foreign investments in India are likely, but managing this increased liquidity will be crucial. Shah highlighted that if the incoming funds aren’t efficiently directed through block deals, bulk deals, or IPOs, the market could face issues. He also emphasized that to maintain investor interest, India’s GDP growth and corporate earnings need to remain strong. Additionally, after the US Federal Reserve announced a 0.50% rate cut, India is expected to become a more attractive market for FIIs compared to other recovering economies.

FPIs Eyeing Large-Cap Stocks Over Mid and Small-Caps

Chokalingam G, founder of Equinomics Research, pointed out that Foreign Portfolio Investors (FPIs) may have missed out on earlier market opportunities in India but are now prepared to capitalize on the growing momentum. Large-cap stocks are likely to see the most attention, as FPIs shift their focus away from small and mid-cap investments. This trend aligns with the increasing appetite of global investors for stable and less volatile investments.

FIIs Show Mixed Activity in First Eight Months of 2024

In the first eight months of 2024, FIIs have shown mixed investment patterns. Out of these months, they made significant purchases in three months, while in August, FIIs were net sellers, withdrawing Rs 51.8 crore from the Indian market. However, September has reversed this trend, indicating growing optimism among foreign investors about India’s economic prospects.

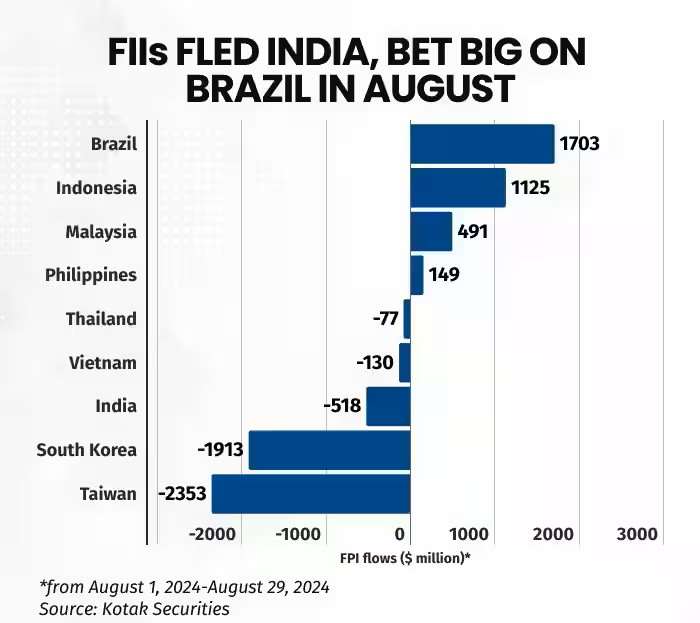

Brazil and Indonesia Attract FII Attention in August

In August, FIIs directed the most capital toward Brazil, where they invested $170 million. Indonesia followed with $113 million in FII inflows, while Malaysia and the Philippines saw more modest investments of $49.1 million and $14.9 million, respectively. India’s strong economic fundamentals and potential for sustained growth make it a compelling choice for foreign investors, despite the competition from other emerging markets.